| | The Daily Reckoning | Thursday, January 6, 2011 |

- A disturbing deluge of apparently "bullish" prognostications,

- Six ideas to set you on the right investing course for the New Year,

- Plus, Bill Bonner with another "prediction-plus" for 2011 and plenty more...

-------------------------------------------------------

Patrick Cox Announces His Predictions for 2011...

Five Market "Wealth Quakes" Could Land You 10,720% Gains in the Next 13 Months

New presentation reveals shocking 2011 predictions! These five "Wealth Quake" events could make you 10,720% richer in the next year...just for starters.

But you must hurry! This epic presentation expires soon. For the biggest shot at huge wealth - watch this right now.

|  | | | | Finding Inspiration in the Most Uninspiring Places | | How to Skew Bad Economic Data to Inspire Investor Confidence | | |  | | Eric Fry | Reporting from Laguna Beach, California...

As we begin a hopeful New Year, investors face a vast array of "knowns" and "unknowns." Most of the knowns are uninspiring, at best.

But so what? The unknowns can be whatever we want them to be...at least until they become knowns. Here... Let us show you how easy it is to turn an uninspiring known into a truly inspirational unknown...

Earlier this week, the Institute for Supply Management (ISM) announced that its index of manufacturing activity was 57.0 in December - a slight increase from November's 56.6 reading, but still well below the 60.4 number from last April.

Seems like an uninspiring report...until you pick up the following day's issue of The Wall Street Journal. "Factory Activity Surged in December," the Journal proclaimed. Based on the numbers, the Journal's account is simply false. But that's not what counts here. What counts is the Journal's rose-hued assessment of future factory activity - i.e. the glorious unknown. In other words, factory activity did not actually surge in December, but it is probably going to in January, right?

Here's another fascinating example of dream-weaving: late last week, Moody's announced that commercial and industrial (C&I) lending squeaked out a 0.2% increase in the fourth quarter. Armed with this thoroughly uninspiring data point, The Wall Street Journal declared, "Banks Open Loan Spigot." False.

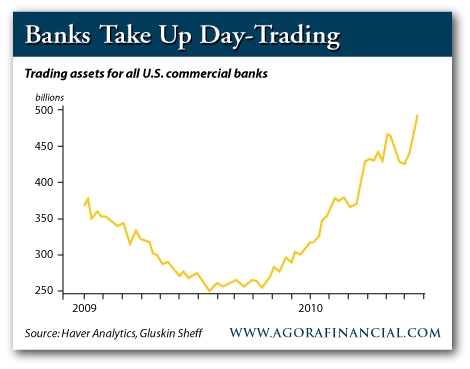

The only spigot that's open inside America's largest banks is that one that pours capital into proprietary trading desks. As the nearby chart illustrates, the volume of "trading assets" at US banks has been soaring. These would be the same "trading assets" that have been producing the perfect and/or near-perfect trading results at Goldman Sachs, JP Morgan and others.

Is it any wonder, therefore, this portion of bank balance sheets is inflating, while traditional components - like actual loans - are either deflating or doing nothing? If you had access to cheap, subsidized government funding, along with simultaneous access to a quasi-monopolistic cartel on the sale of the government's own securities, would you bother making a loan?...Nah, we wouldn't either.

But we digress...

Let's take a peek at another uninspiring data point. Just this morning, the Labor Department announced that initial claims for unemployment during the past week increased by 18,000 to 409,000 newly unemployed individuals. Bloomberg News responded with the twin headlines, "Unemployment Claims Over Past Month Drop to Lowest Level Since July 2008," and "Dollar Rallies on Optimism Over Stronger Job Market."

See how easy this is? If you get a tepid factory utilization report, no problem. Call it, "US Factories Ready to Power Ahead as Economy Gathers Steam." If you get a lousy retail sales report, don't worry. Describe the setback as, "Blizzard Impedes Resurgent Consumer Spending."

Go ahead; try it at home. It's fun for the whole family.

You could say that investors are good at making something out of nothing. But isn't that also what LSD accomplishes? Outside of the financial realm, chronic self-delusion usually requires some combination of therapy and/or rehab. But inside the financial realm, self-delusion is not only normal, it is often very profitable...at least for a while.

"What is fascinating in the markets," economist David Rosenberg observed recently, "is that so many people can be right despite all their assumptions and lines of reasoning being totally off-base. That was the case in 2010 - go back to the consensus in Barron's a year ago and you'll see that the bullish prognostications at the time were optimistic because of visions of a sustainable V-shaped recovery taking hold." The Dow rallied about 13% during the year, even though a V- shaped recovery never materialized.

But that was last year. What about this promising new year?

Well, as Rosenberg points out, a short list of knowns provides little comfort:

1. Stubbornly high unemployment rate (at 9.8%, not far off the recession high of 10.1%)... Continuing claims today, at 4.1 million, compared with 3.1 million back in 2008; extended benefits today are at 819,000 versus zero back then...

2. Deflating home prices - in fact, not only did Case-Shiller home prices decline 1.3% month-over-month in October, but all 20 cities showed a sequential decline, and this last happened in February 2009...

3. Huge state/local government budget gaps ($65 billion this year) will be closed with tax hikes, user fees and service cutbacks. The biggest myth being promulgated today is that the economy must be doing better because state/local government revenues are on the rise. Dude! That's not the economy! It's called tax increases...

4. Surging energy prices - oil prices have broken above $90 a barrel...

5. Slowing global growth, as flagged by the decline in the Chinese stock market... "From our lens," Rosenberg concludes, "at current valuations, the good news appears to be fully priced in and then some." Nevertheless, Rosenberg admits, "[Only] a fool would say that this overextended market could not become even more extended in coming months."

But whatever sort of market is coming our way in 2011, Chris Mayer, editor of Mayer's Special Situations, advises focusing on the knowns...especially the kinds of knowns that typify compelling investment opportunities, no matter what the overall market environment may be. Read on...

| | |  | | Did You See The Video About The American Nuke Bomb LOST Under Ancient Ice Fields? |

Way back in 1968, an American B-52 crashed in northwest Greenland...

Unfortunately, the nuclear bombs on board got forever swallowed by an ancient ice sheet...

But there's an unknown penny stock set to rise 2,000% from this sorry situation.

Sound unbelievable? Watch this presentation for proof...

| |  |

| | The Daily Reckoning Presents | | New Year's Resolutions and Predictions | | |  | | Chris Mayer | The New Year invites guesses about the year ahead. I thought I wouldn't bother this year, but then I found myself scribbling out some investment resolutions and predictions on a napkin over breakfast. Here are some of them:

1. Ignore the "gold is in a bubble crowd." The mainstream press doesn't understand gold. They look at the price and think it's expensive. Instead, they should turn it around and question the value of the dollar. Gold is best thought of as a play on the creditworthiness of paper money. When people worry about the printing presses, gold does well. As most governments have huge deficits to finance, gold shouldn't collapse.

Besides, on an inflation-adjusted basis, gold is still below its all- time high in 1980. It would have to trade north of $2,000 an ounce to break it.

Gold stocks are the best way to play gold because they are going to put up a stellar year of earnings in 2011. Many will mint money at $1,400 an ounce. Stay long gold stocks.

2. Stick with the fundamentals. People come up with all kinds of crazy indicators to try to predict what the market is going to do. The year 2010 had a couple of really silly ones that got a lot of press. Anyone remember the "Hindenburg Omen?" That people gave any credence to this idea at all makes me wonder about the survivability of our species.

But it wasn't the only one. I clipped out and saved a column from Barron's dated July 5, 2010, giving serious ink to the idea of the "Death Cross" - another indicator that cropped up in 2010 and predicted the market would crash. Of course, the market is 25% higher since.

Ignore these contrivances. The future is unpredictable. You're better off studying businesses and trying to buy only cheap stocks. Move to cash when you can't find anything to buy and wait. It's worked for me anyway.

3. Question the "US blue chips are cheap" argument. This one is controversial because you couldn't find a money manager today who doesn't think US blue chips - Microsoft, Johnson Johnson, Kraft and the like - are cheap. Nearly everyone does. That's the problem. Something is wrong here.

Microsoft trades at only 12 times earnings, but perhaps deserves that multiple. Yes, it generates a lot of cash, but it has done little with it for shareholders' benefit. The problem is that a lot of these big firms hoard cash, earning nothing, or spend it on value-destroying acquisitions. All that great cash flow these firms generate never gets into shareholders' pockets.

Microsoft, Hewlett-Packard, Cisco and Intel are examples of companies that throw off lots of cash and carry excess cash...yet pay hardly anything to shareholders.

As Bill Miller, manager of the Legg Mason Value Trust, points out:

"[These companies] all could EASILY pay out 70% of their free cash flows as dividends and still build cash on the balance sheet. If they did so, it is hard (nay, impossible) to believe their stocks would not move dramatically higher. My guess is that at worst they would trade at between a 4% and a 5% dividend yield, about where much-slower-growing utilities trade, providing an immediate gain of over 30% to their owners."

I agree. If big blue chips were smart allocators, they'd be great investments. Look at what McDonald's has done. Or even IBM, which trades at a higher price-to-earnings ratio than Microsoft, a notoriously poor allocator of capital.

Until these big blue chips start thinking about shareholders, I don't think they are especially cheap. They probably trade where they should trade.

Meanwhile, I still find better bargains among smaller-cap stocks, in which the people running the show have skin in the game. I'd rather invest in these names than some giant corporation that hands its executives lush option packages. Over the long haul, I prefer "owners" versus "renters."

4. Stay with commodities where supply is tight and there is no immediate cure. I think 2011 will be more difficult for commodity investors. Mining companies are pouring record amounts of cash toward new projects. That's like turning on the shot clock in basketball. There is a window to score here, but it is closing. Some commodities, though, ought to do better than others.

There is an old market saying that says, "Good things happen to cheap stocks." Even though we can't predict when things will happen, a cheap stock usually doesn't need much help to produce a sizeable gain. In the commodity world, a similar saying might be "Good things happen to commodities where supply is tight and finding more is not easy."

Coking coal is a good example. Quality deposits are hard to find. Steelmakers are looking all over the world for new sources of supply. But then, in recent days, the sky opened up in Australia. The rain was so torrential, it's halted exports of about 40% of the world's coking coal. A whole bunch of companies declared force majeure, saying they would not be able to meet supply contracts.

No one could've predicted that, but good things tend to happen to such commodities. Coking coal prices will surely spike upward in the second quarter. Already, coking coal contracts for January-March are $225 a tonne, the second highest on record.

For 2011, I'd say uranium has the most upside potential, outside of the precious metals. Even though prices rose in 2010, they still don't compensate miners for the risk of building new mines. It's also a very concentrated industry, like coking coal. More than 60% of all uranium comes from just 10 mines. Stay long those uranium stocks.

What about the biggest potential correction on the downside? I'd say agricultural commodities. We're going to see record planting all over the world. My guess is that these plantings will be enough to dent to the run of commodities such as wheat and corn. Good for stocks such as Pilgrim's Pride (NYSE:PPC), though, which should enjoy a fall in feed costs.

5. Keep traveling. I always learn something new when I travel and often uncover new investment ideas as well. All of which is to say it's a good thing to leave your desk and step out into the world. This year, I have a number of places and people I'd like see and meet. For instance, in March, I plan to check out Colombia. And in May, I hope to visit South Africa.

6. Keep a sense of humility. The most important resolution is one I make to myself every year: It is to keep a sense of humility about the markets. Unpredictable things happen all the time. There is some element of luck involved, for good or ill. And everyone - no exceptions - gets his head handed to him at some point or other in his investing life. If you play long enough, you will have your share of losses and disappointments. As Roy Neuberger wrote in his memoir, So Far, So Good: The First 94 Years: "Always-right investors don't exist, except among liars."

So there is no room for overconfidence, stubbornness or arrogance. Take your gains and losses with cheerfulness and a light touch. Don't be afraid to say, "I don't know." Keep an open mind. Keep learning. And enjoy the ride.

Here's to 2011!

Regards,

Chris Mayer,

for The Daily Reckoning

Joel's Note: If this kind of philosophy seems to make sense, that's probably because it does. Chris's Capital Crisis readers enjoyed a stellar 2010, as evidenced by this short note he penned them at the end of the year:

"The overall average gain per recommendation is up to 25.8%, with a holding period of about 1.5 years. Annualized gains come to about 16.1% since July 2004."

Average recommendation up more than 25%? Annualized gains over 16% per year? Umm...yeah, that makes sense.

If you're interested in joining Capital Crisis in 2011, here's a direct link to the order form. It takes about three minutes to fill out and membership only costs a couple of bucks a week. And there are a bunch of other bells and whistles you get if you sign up now. Do yourself a favor and become a member today.

| | |  | | Outstanding Investments Introduces... |

Nine Simple Ways You Can STILL Get Rich With Gold in 2011

Even as gold soars to record new highs, a respected Harvard geologist reveals how you can STILL use gold nine different ways to get rich.

Get the details on this epic profit forecast - right here.

| |  | | | | Bill Bonner | | US Economic Decline a Believable Scenario | | |  | | Bill Bonner | Reckoning from Baltimore, Maryland...

Did we give you all our Predictions-Plus? You know, the things you OUGHT to believe, even if they are not guaranteed, sure-fire, absolutely, 100% in-the-bag.

Here's another one:

The US Empire Has Peaked Out.

We don't know if it is true or not. And in the last two centuries it was a mistake to bet against America.

But this is the 21st century. Things have changed.

Where is the world's fastest train?

Where is the world's tallest building?

Where is GDP growing fastest?

Where are most cars being made...and sold?

Who graduates the most engineers? Who pours the most cement? Who produces the most steel?

The fact is, if the word has an "est" on the end of it, it is probably not referring to the USA. Unless it is talking about debt. Of which, the US has the MOSTEST in the world.

What a change this is from a few years ago. Remember when the US was on top of the world...trying to get other nations to straighten up? Now, it's America who is slouching...while the rest of the world wags its finger.

Here's The Telegraph:

"We're not going to allow our American friends to melt the dollar," said Mr. Mantega, [Brazil's finance minister] who views the US government's move to pump $600bn (£387bn) into its economy as an unfair attempt to help exports.

"There are infinite measures that we can take. One of them is to manage the entry of speculative capital in the short-term."

His comments came after Chile's central bank announced a plan to buy $12bn (£7.7bn) of US dollars on international markets on Monday in an attempt to stem its own currency appreciation.

The Chilean peso has gained by more than 17pc cent against the US dollar since June, fuelled by increases in the price of copper, which is Chile's biggest export.

It was Mr. Mantega who coined the term "currency war" last year as he voiced concerns that Brazilian exports were being damaged. In October he tripled the tax on foreign investments in some bonds to six per cent, a measure he said had since been "effective". Now, it's the "banana republics" that are doing the responsible thing. They're trying to protect themselves.

It's the US Fed that has gone bananas - trying to print its way out of a debt deflation.

The emerging economies are growing fast - like the US in the 19th and early 20th centuries. In a few years, if this continues, they'll overtake America as the biggest economies on the planet. Then, a few years later, they'll have the most lethal military forces too.

Maybe it won't happen. We don't know. We can't tell you what tomorrow's newspapers will say, let alone those 10 or 20 years in the future.

But this is not an ordinary prediction. This is a "Prediction Plus." You ought to believe it, even if it turns out not to be true.

Why?

Because there's a downside to every upside...

Because every empire eventually declines...

Because the US is a high-cost, high tax, high debt economy, competing against cheaper economies less burdened by debts and taxes...

Because the US is full of zombies, people who produce nothing, while emerging markets are relatively zombie-free...

Because the US has enjoyed two centuries of success; failure is bound to await somewhere...

Because the US is broke...with a $200 trillion funding gap...

Because US labor claims to be "skilled"...but what kind of a skill is a degree in "communications" or "sociology"?

And because US assets are already fully priced - as if the US could expect to be the world's hegemonic power forever.

Because...because...because...

Most importantly, investors still buy US bonds and the US dollar in a crisis. When the real crisis comes, they'll wish they had bought something else.

Regards,

Bill Bonner,

for The Daily Reckoning

-------------------------------------------------------

Here at The Daily Reckoning, we value your questions and comments. If you would like to send us a few thoughts of your own, please address them to your managing editor at joel@dailyreckoning.com

| |  |  |  |  | What to Believe About Gold, Stocks and Bonds in 2011

What should you believe about gold? It's going up. Yes, we know...it might go down. Yesterday, gold dropped $44 dollars. Whee! We've been warning you for months that gold could correct. No bull market goes up in a straight line. And gold has already attracted too many speculators who don't really know what they are doing.

Reexamining the Income-Expense Ratio

Contrarian Investing and Predictions-Plus for 2011 | Verbosity is the Soul of Financial Fury

I saved [old Mogambo Guru] because it was so good, in that pithy, "brevity is the soul of wit" sort of way that I hope to one day master, although it won't be anytime soon because I can never seem to be brief, in that the outrageous over-creation of money by a destructive, idiotic Federal Reserve...

Price Inflation to Pay the Debt

The Nomadic Nature of Money | A Day in the Life of the National Debt

As an example of the kind of sheer monetary insanity that is happening all around us and that is going to destroy the United States of America, and probably most of the world, too, the national debt of the United States of America hit a new, all-time record: An astonishing $14,025,215,218,708.52...

Is the Gold Sell Off Only Temporary?

The Year of the Silver Hare |  |

| | The Daily Reckoning: Now in its 11th year, The Daily Reckoning is the flagship e-letter of Baltimore-based financial research firm and publishing group Agora Financial, a subsidiary of Agora Inc. The Daily Reckoning provides over half a million subscribers with literary economic perspective, global market analysis, and contrarian investment ideas. Published daily in six countries and three languages, each issue delivers a feature-length article by a senior member of our team and a guest essay from one of many leading thinkers and nationally acclaimed columnists. |  |

| | | | | Additional articles and commentary from The Daily Reckoning on: |  | Twitter |  | Facebook |  | DR iPhone APP | To end your Daily Reckoning e-mail subscription and associated external offers sent from Daily Reckoning, cancel your free subscription. If you are you having trouble receiving your Daily Reckoning subscription, you can ensure its arrival in your mailbox by whitelisting the Daily Reckoning.  © 2010-2011 Agora Financial, LLC. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This newsletter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the World Wide Web), in whole or in part, is strictly prohibited without the express written permission of Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Nothing in this e-mail should be considered personalized investment advice. A lthough our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice.We expressly forbid our writers from having a financial int erest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of a printed-only publication prior to following an initial recommendation.Any investments recommended in this letter should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company. © 2010-2011 Agora Financial, LLC. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This newsletter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the World Wide Web), in whole or in part, is strictly prohibited without the express written permission of Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Nothing in this e-mail should be considered personalized investment advice. A lthough our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice.We expressly forbid our writers from having a financial int erest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of a printed-only publication prior to following an initial recommendation.Any investments recommended in this letter should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

| | |  |

© 2010-2011 Agora Financial, LLC. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This newsletter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the World Wide Web), in whole or in part, is strictly prohibited without the express written permission of Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Nothing in this e-mail should be considered personalized investment advice. A lthough our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice.We expressly forbid our writers from having a financial int erest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of a printed-only publication prior to following an initial recommendation.Any investments recommended in this letter should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2010-2011 Agora Financial, LLC. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This newsletter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the World Wide Web), in whole or in part, is strictly prohibited without the express written permission of Agora Financial, LLC. 808 Saint Paul Street, Baltimore MD 21202. Nothing in this e-mail should be considered personalized investment advice. A lthough our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice.We expressly forbid our writers from having a financial int erest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of a printed-only publication prior to following an initial recommendation.Any investments recommended in this letter should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

No comments:

Post a Comment